Revolutionizing Traditional Financial Systems

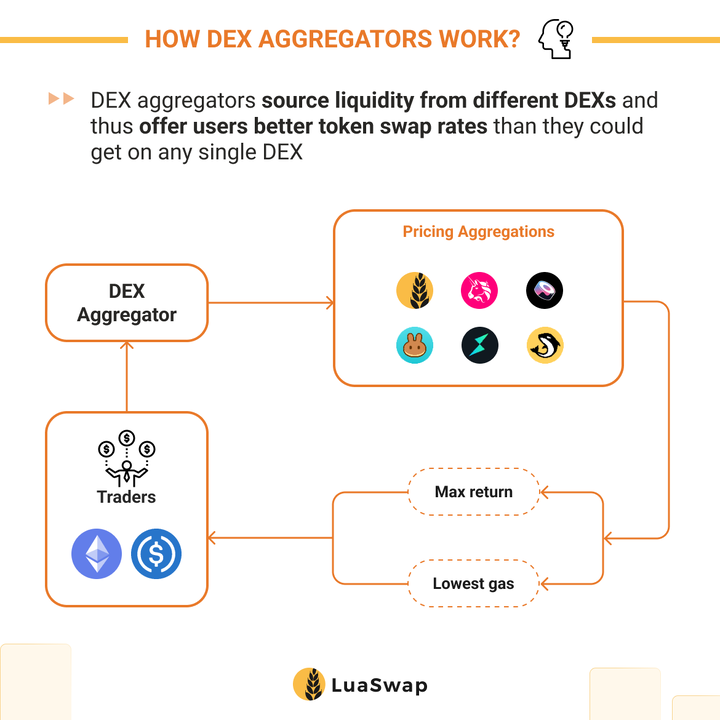

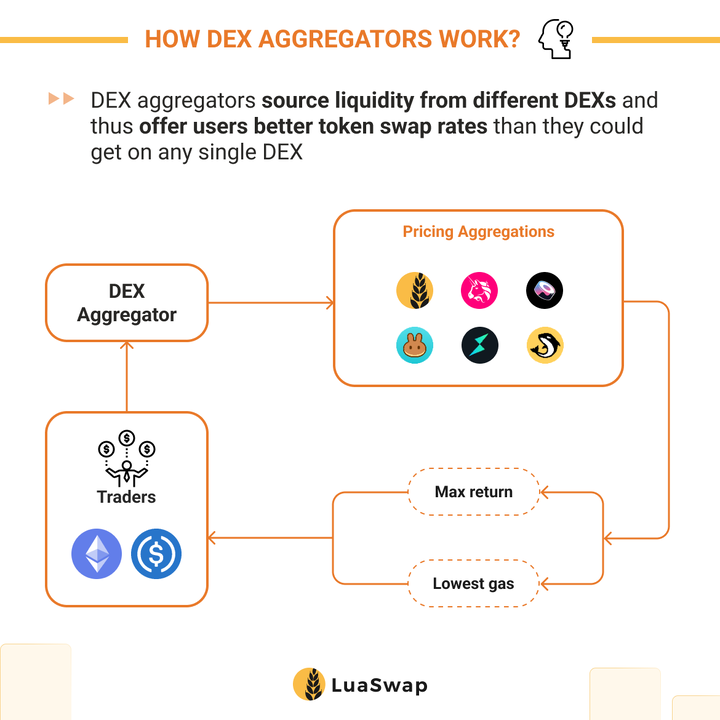

In 2024, DeFi continues to disrupt traditional financial services by offering decentralized alternatives to banking, lending, and trading. By removing intermediaries such as banks, DeFi platforms enable peer-to-peer financial transactions, improving efficiency, transparency, and accessibility for users worldwide.

📊 Key DeFi Trends in 2024: ✅ DeFi Lending and Borrowing: Platforms like Aave and Compound allow users to lend their assets for interest or borrow against their crypto holdings without the need for a bank.

✅ Staking and Yield Farming: Crypto investors are earning passive income through staking (locking up tokens for rewards) and yield farming (providing liquidity to decentralized exchanges).

✅ Synthetic Assets: DeFi protocols are offering synthetic assets, enabling users to trade real-world assets like stocks and commodities on blockchain networks.

📌 Impact on Users and Businesses: 🔹 DeFi offers more financial inclusion by providing access to banking services for unbanked populations.

🔹 Transparency and security are enhanced as transactions are recorded on public blockchains.

🔹 Lenders and borrowers benefit from faster transactions and lower fees than traditional banking systems.

🚀 Looking Ahead: In the future, DeFi platforms will likely integrate more advanced financial instruments such as insurance and decentralized prediction markets.

2. Central Bank Digital Currencies (CBDCs): Governments Take the Lead

The Future of National Currencies on the Blockchain

While many cryptocurrencies are decentralized, some governments are exploring the concept of Central Bank Digital Currencies (CBDCs). These are government-backed digital currencies designed to function alongside physical money. In 2024, more countries are piloting and launching CBDCs, seeking to modernize the monetary system while maintaining government control over their economies.

📊 Key CBDC Trends in 2024: ✅ China’s Digital Yuan: China has been at the forefront of CBDC development, and the Digital Yuan continues to expand, offering a digital alternative to traditional currency.

✅ Cross-Border Payments: CBDCs are being tested for use in international transactions, with countries like the EU and Japan exploring cross-border CBDC payments.

✅ Financial Inclusion: CBDCs are seen as a tool for providing financial services to the unbanked, especially in developing countries.

📌 Impact on Businesses and Consumers: 🔹 Faster and cheaper transactions will be a significant benefit of CBDCs, especially for cross-border payments.

🔹 Governments will have more control over monetary policy, including the ability to track and manage transactions.

🔹 Privacy concerns may arise as governments potentially gain the ability to monitor transactions more closely than with cash.

🚀 Looking Ahead: As CBDCs evolve, expect them to integrate with blockchain technology, creating digital economies that enhance efficiency while maintaining state control.

3. The Evolution of Bitcoin and Ethereum

The Founding Titans of the Crypto Space

Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, continue to evolve in 2024, each with its own set of innovations and challenges. Bitcoin remains the gold standard of digital currencies, while Ethereum continues to be the preferred platform for decentralized applications (dApps) and smart contracts.

📊 Key Trends for Bitcoin and Ethereum in 2024: ✅ Bitcoin’s Institutional Adoption: In 2024, Bitcoin is increasingly being adopted by institutions as a store of value, similar to gold, with companies like Tesla and MicroStrategy holding significant BTC reserves.

✅ Ethereum 2.0: Ethereum’s transition to Ethereum 2.0, powered by the proof-of-stake (PoS) consensus mechanism, is set to improve scalability, security, and energy efficiency.

✅ Layer 2 Solutions: Ethereum’s scaling issues are being addressed with Layer 2 solutions like Optimism and Arbitrum, which provide faster, cheaper transactions without compromising security.

📌 Impact on Investors: 🔹 Bitcoin is viewed as a hedge against inflation, with institutional investors treating it as digital gold.

🔹 Ethereum is poised for widespread adoption, especially in sectors like finance and art, thanks to its smart contract capabilities.

🔹 Layer 2 solutions are providing an answer to scalability issues, improving the overall user experience.

🚀 Looking Ahead: In the coming years, Ethereum’s dominance in the DeFi and NFT markets will continue to grow, while Bitcoin remains the cornerstone of cryptocurrency investment.

4. NFTs and the Metaverse: Digital Assets of the Future

The Intersection of Art, Gaming, and Ownership

Non-fungible tokens (NFTs) exploded in popularity over the last few years, and in 2024, they continue to transform the concept of ownership and digital assets. While NFTs are primarily known for their association with art and collectibles, they are now expanding into other areas, including gaming, real estate, and virtual goods within the metaverse.

📊 Key NFT Trends in 2024: ✅ NFTs in Gaming: Gamers are using NFTs to own in-game assets, such as skins, weapons, and characters, which can be traded or sold.

✅ Virtual Real Estate: NFT-based land in the metaverse is becoming an investment opportunity, with platforms like Decentraland and The Sandbox seeing increasing demand.

✅ NFTs for Real-World Assets: NFTs are being used to tokenize physical assets such as real estate and luxury goods, providing proof of ownership and authenticity.

📌 Impact on Creators and Consumers: 🔹 Creators can monetize their work directly through NFTs, earning royalties every time their digital art is resold.

🔹 The gaming industry is seeing a massive shift as NFTs become a central feature in play-to-earn models.

🔹 Virtual land and digital goods are becoming legitimate assets that can be bought, sold, and traded in virtual economies.

🚀 Looking Ahead: NFTs are set to become even more integrated into the metaverse as digital ownership expands across gaming, real estate, and entertainment.

5. Crypto Regulation: The Push for Legal Frameworks

Regulatory Landscape Evolves

As cryptocurrency adoption continues to grow, so does the need for clear regulatory frameworks. In 2024, governments and regulatory bodies worldwide are working to establish rules that will ensure consumer protection and prevent illicit activities, while also promoting innovation.

📊 Key Regulatory Trends in 2024: ✅ Global Coordination: Countries are coming together to create international regulations for crypto, focusing on anti-money laundering (AML) and know-your-customer (KYC) requirements.

✅ Stablecoin Regulation: Stablecoins, which are pegged to traditional currencies like the US dollar, are under scrutiny, and regulators are considering new rules to ensure they are backed by real assets.

✅ Taxation of Crypto: Tax authorities are developing frameworks for taxing cryptocurrency earnings, ensuring that investors and businesses comply with tax laws.

📌 Impact on the Industry: 🔹 Clear regulations will bring legitimacy to the cryptocurrency space, attracting institutional investors.

🔹 Regulatory clarity will reduce the risk of fraud and scams in the market.

🔹 Businesses will need to adapt to KYC/AML compliance and potentially report crypto transactions for tax purposes.

🚀 Looking Ahead: Regulatory clarity will pave the way for more institutional adoption and create a more secure and trustworthy environment for crypto investors and businesses.

Final Thoughts: What’s Next for Cryptocurrency?

The cryptocurrency space is constantly evolving, and 2024 is shaping up to be another exciting year for blockchain innovations, decentralized finance, and digital currencies. As new technologies, regulatory frameworks, and use cases emerge, the future of crypto looks bright, with greater adoption and integration into mainstream finance.